For anyone who is taking advantage of cheap gas to migrate their assets from Aave V1, featuring:** Aave Weekly ⚡️ , Risk 🔎 , State of the protocol 📰 , Ecosystem 🧉 , Governance ⚖️, Upcoming events 📆 ,** and Water cooler 🆒

Aave Weekly ⚡️

The Aave Weekly Newsletter brings readers insights on protocol liquidity, income and other performance metrics.

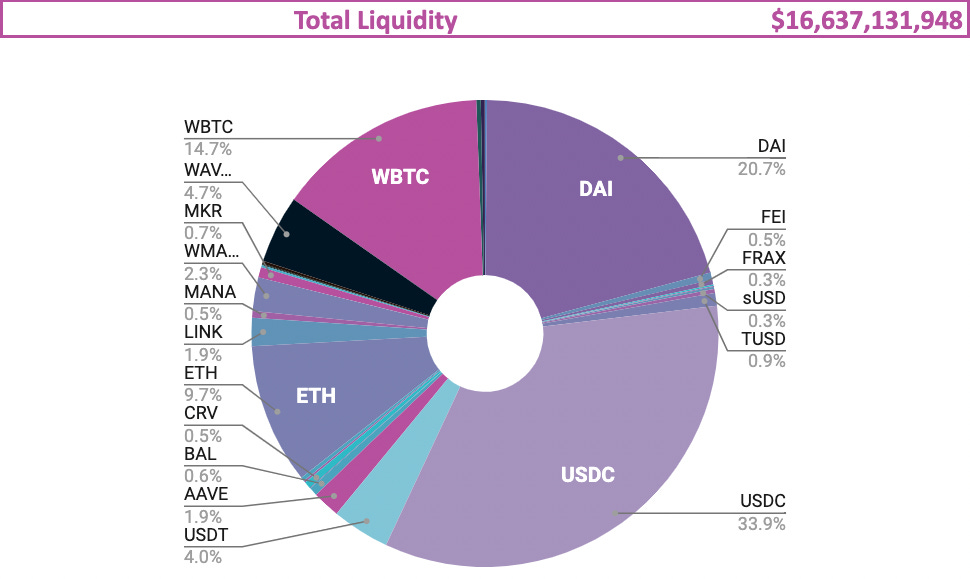

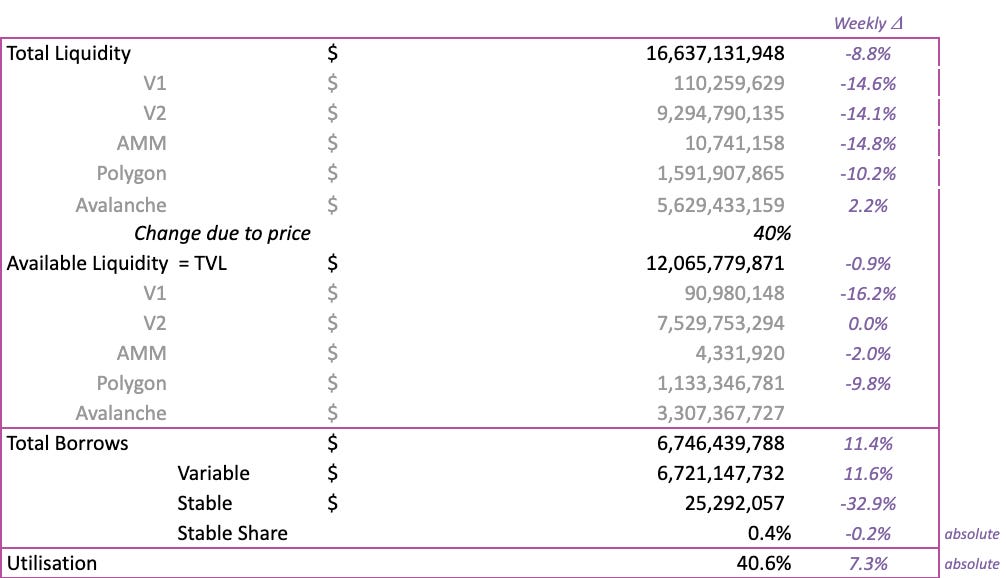

The Aave Protocol closes week 9 of 2022 with $18.2 billion of liquidity:

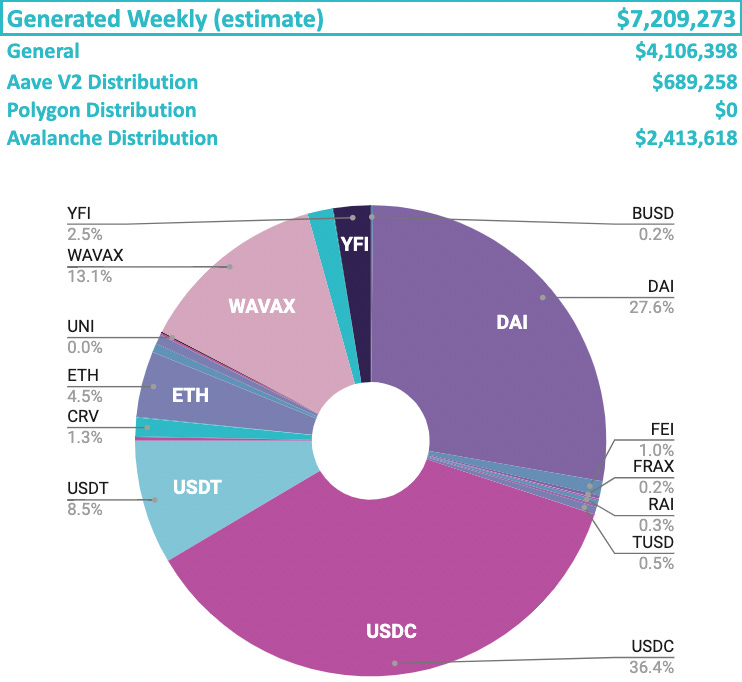

- 33.2% Utilisation, generating $3.6m of estimated interest for depositors

- $101m of Flash Loan volume, generating $91k of fees for depositors

- $23m liquidated, generating $1.8m of fees to liquidators

- $444k for the ecosystem collectors now holding $44m

- $5.9m generated by the protocol this week

- With an additional $1.1m $StkAAVE & $2.2m $WAVAX distributed *at the weekly close price

Protocol Liquidity

Protocol Usage

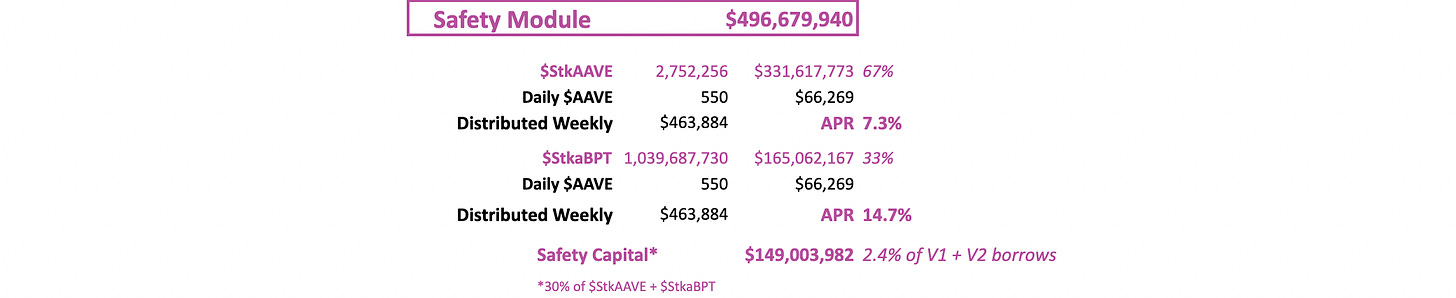

Safety Module

You can download the Aave Weekly pdf from the governance forum.

Risk 🔎

In case you haven’t seen it, check out the Aave Risk Dashboard by Gauntlet at gov.gauntlet.network/aave. The Gauntlet team is particularly keen on iterating on this dashboard for the community and would love feedback via this Google Form

For more details on how Gauntlet manages market risk for Aave, please see Gauntlet’s Parameter Recommendation Methodology and Gauntlet’s Model Methodology

State of the protocol 📰

- After a successful on chain vote, ENS has been added as collateral to Aave V2 and users can now deposit ENS with a 50% LTV Ratio

- A Snapshot vote from Llama to add CVX is live until March 9th - it’s an opportunity to capitalize on the borrow demand by being the first major lending market to list CVX

- An AIP is currently live to have UST listed on V2 - voting is live until March 10th

Ecosystem 🧉

- Review the most recent grantees from Aave Grants including Increment, Questbook (they’re hiring!), and Bribe Protocol 👀

- Symphony Finance is hosting their first community call on March 10th - help spread the word and contribute for a chance to win $$$ 🎹

- DappLooker updated their Aave V2 and Polygon user retention dashboards with data from February 🔢

- Aave Companies is hiring a writer ✍️

- Lens Protocol announced the LFGrow Hackathon with ETHGlobal, a web3 social media hackathon to build on top of Lens Protocol with $200,000 in prizes - check out what is already being built 🌿

- Christina from Aave Companies was featured in a Bankless livestream on The Social Web3 & GM, web3 ✨

- Listen to a recording of Aavegotchi’s Twitter Space on Aavegotchi Haunt 1 Anniversary + Gotchiverse Alpha 👻

- Paladin is offering a 250 PAL bounty to anyone who can find a better stAAVE yield than what they provide (18.5% + PAL) 🛡️

Governance ⚖️

On-chain votes:

- Add Terra USD (UST) to AAVE v2 | Governance discussion (most recent) | 🗳 Vote until March 10th

- Add ENS to Aave V2 | Governance discussion | ✅

- Risk Parameter Updates 2022-02-24 | Governance discussion | ❌ Failed to meet quorum

Snapshot votes:

- ARC Add support for CVX | Governance discussion | 🗳 Vote until March 9th

Other discussions from the forum:

- Early Contributors Program Launches: Sacred’s DeFi-Integrated Mixer

- Proposal: Add support for rETH Token

- Proposal: Aave Interest Rate Uber Model v0.1

- ARC: Risk Parameter Updates 2022-02-24

- ARC: Proposal to add support for USX

- Listing Proposal: Add UMA as collateral on Aave

Upcoming Events 📆

- LFGrow - March 18 - 30

- Avalanche Summit - March 22 - 27

- ETH Amsterdam - April 22 - 24

- Permissionless - May 17 - 19

Water cooler 🆒

Where do you think the next raave will be?