September & October grants, recent grant completions, and ETH Global NYC hackathon winner

Overview

This update includes new grants given out during September and October, a recap of hackathon winners from ETHGlobal NYC, an update on distributing grants in GHO, and more.

Grants Summary

Total numbers for the grants program’s spending are listed below starting from mid-May of 2021 when the program began up until the end of July.

-

Total Grant Applications Received: 2317

-

Total Applications Approved: 259

-

Acceptance Rate:

-

written(stage 1): 11%

-

video call(stage 2): 72%

-

-

Total Amount Dispersed:$5,113,753

-

Complete Grant Payments: 87%

-

In-progress/Incomplete Grant Payments: 13%

-

Status of all grants:

-

Complete/Live - 68.5%

-

In-progress - 25.6%

-

Inactive - 5.9%

-

-

Amount and Quantity Approved by Category:

-

Category - $cumulative cost - number approved

-

Applications and integrations - $2,851,066 - 118 grants

-

Code audits - $110,000 - 4 grants

-

Committees & DAOs that serve Aave’s ecosystem - $703,780 - 20 grants

-

Community (marketing and educational) - $701,050 - 54 grants

-

Developer tooling - $415,000 - 13 grants

-

Events / Hackathons / Sponsorships - $186,000 - 14 grants

-

Other - $294,900 - 12 grants

-

Protocol development - $446,200 - 21 grants

-

Approved Grants

This September & October we received 153 grant applications and sent out funds for 7 new grants. The 7 awarded grants totaled $92,500 in funding with all of the projects focusing on applications and integrations. Listed below are the awarded grants for both months ranging from largest to smallest by funding size:

-

Grant Name - $ total grant amount(payment type) - grant type

-

grant description - “grantee self-description”

-

use of funds

-

September

-

Polynomial Protocol - $25,000 - applications and integrations

-

Polynomial trade is a decentralized derivative trading exchange powered by the Synthetix protocol on Optimism. They are building a product feature that will use Aave flash loans for funding rate arbitrage, a popular delta-neutral trading strategy they are implementing after talking with their users. It will be accessible via their Polynomial Trade Strategies.

-

funds will be split between development costs, incentives, and community engagement/marketing costs

-

-

Wasabi Protocol - $12,500 - applications and integrations

-

“Wasabi unlocks Aave liquidity for levered token exposure. Buyers access liquidity previously reserved for borrowers. Facilitating margin trading with minimal upfront investment, slippage, and direct token price impact. This improves capital efficiency and interest earned on Aave.”

-

funds will go towards smart contract development and integration of Aave in Wasabi’s new derivatives product

-

-

Alcor Finance - $5,000 - applications and integrations

-

“@alcor_finance is a next-generation options AMM. It’s capital efficient, completely decentralized, and allows liquidity providers to earn the spread fees from options market-making. Liquidity providers will be able to keep funds in Aave to earn additional APY.”

-

funds will go toward smart contracts and a front-end development of their options AMM

-

-

Clique(payment pending) - $3,000 - applications and integrations

-

As part of an upcoming attestation campaign on Optimism, Clique will increase Aave’s V3 retention rates, cross-pollinate between users of similar protocols, identify power users, and target growth through user recognisability

-

funds will be used as incentives for the attestations generators in the campaign led by Clique

-

October

-

Ambos Finance - $25,000 - applications and integrations

-

“@ambosfinance is on a mission to simplify DeFi lending for both crypto natives and newcomers. By creating a state-of-the-art UX and UI, they aim to make Aave more accessible and user-friendly for all.”

-

funds will go towards the team’s full-time efforts in developing a solid PoC

-

-

Aeris Protocol - $20,000 - applications and integrations

-

Aeris is building under-collateralized loans for institutions on top of Aave without changing the risk profile for Aave lenders

-

funds will go towards two full-time developers building the product throughout ~10 weeks

-

-

Flair (payment pending) - $2,000 - developer tooling

-

“Flair offers reusable indexing primitives (such as fault-tolerant RPC ingestors, custom processors, re-org aware database integrations) to make it easy to receive, transform, store, and access your on-chain data from any EVM chain.”

-

funds will go toward developing indexing templates for the Aave protocol, allowing projects building on top of Aave to get the on-chain data they need with full customizability of what and how they want the data.

-

Grant Completions and Updates

-

AAVE-based CIAN Strategies a grant from February has been completed and is live with users recursively staking their MATIC/MATICX up to 6X leverage along with other LSD pairs like wstETH/WETH and stMATIC/MATIC

-

flaex a grant from January who are building a decentralized margin trading exchange building on Arbitrum are actively looking for early users to join their Private Mainnet Beta. If you are interested, fill out this form 1 to get whitelisted and receive 5 USDC for participating.

-

Concero announced their staking aggregator which is built with Aave protocol at its core

-

Libree has shared a demo of their credit delegation tool building on Aave credit delegation properties

-

Sommelier launched their Trubo GHO Vault with an initial focus on LPing the GHO-USDC pair on Uniswap V3. The GHO Liquidity Committee trialed using the vault which currently has close to $3 million in deposits).

Events Summary

Around the end of September AGD helped represent Aave at ETHGlobal NYC where we sponsored four prizes under two categories. Below are the teams that won each prize and a link to their hack.

-

Best Aave Integrations: Demonstrate innovative financial use cases by integrating Aave V3

-

Best Uses of GHO: Dream of a future where GHO functions as the efficient online payment layer

-

$3,000 USDC - Bounce 1 - Non-custodial real-world NFC card peer-to-peer payments based on PoS terminals.

-

$2,000 USDC - Upper Social - Where Social meets Finance.

-

Ongoing Updates

AIP 333 passed at the start of October which swapped part of AGD allowance from aDAI to GHO thanks to @TokenLogic. We have since paid out our first GHO grants, increasing its use and distribution.

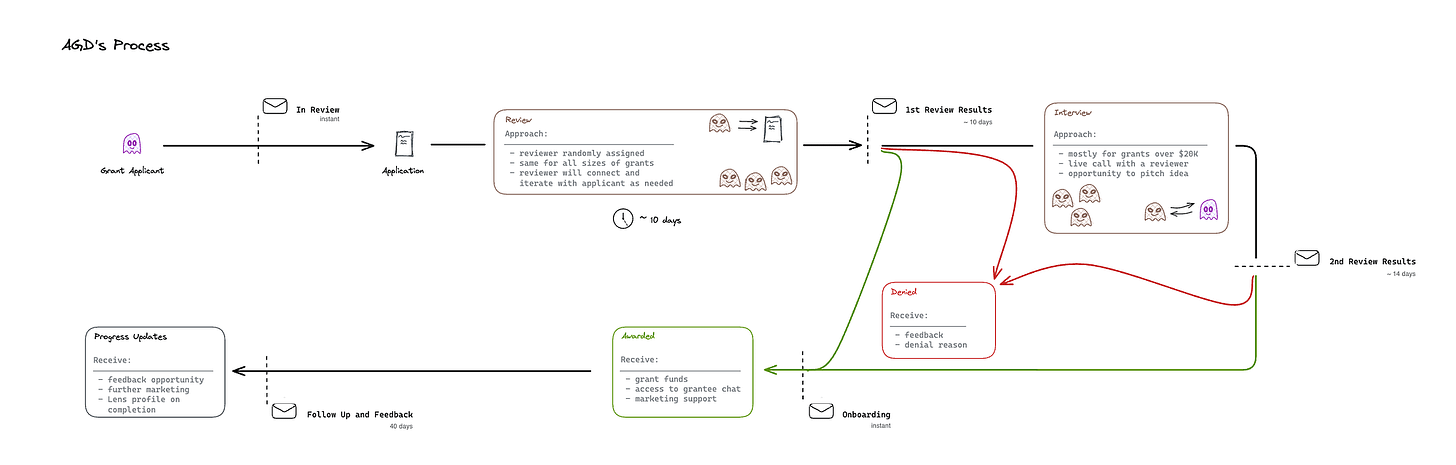

We are currently still looking for applications around the RFGs we published and encourage any interested teams to apply. Our process is simple and well-automated so please don’t hesitate. See an outline of the complete process flow below.

Lastly, the next steps of our continuation proposal are pending so keep an eye out for that.Thanks for reading our September & October update and keeping up with the Aave grant recipients.