For anyone who collected the last edition of Aave News on Lenster, including: Spotlight 🔦 | Protocol 📰 | Ecosystem 🧉 | Governance ⚖️ | Events 📆 | Hey Anon 👻

// Spotlight: DappLooker 🔦

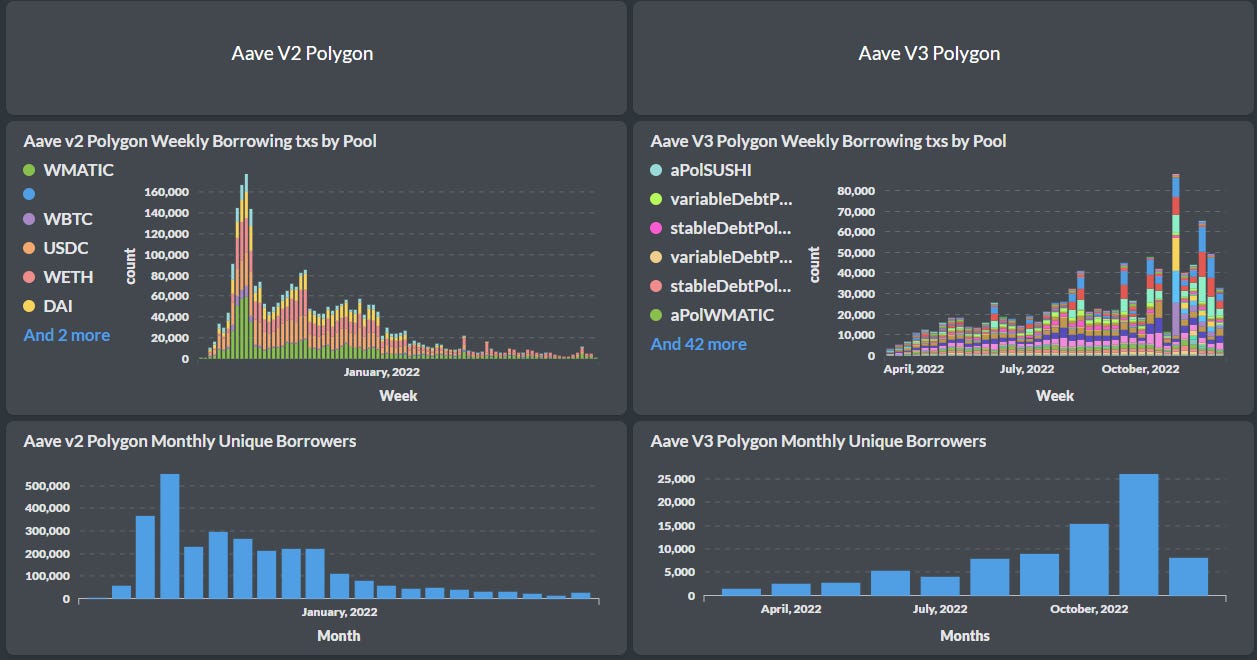

DappLooker’s new user retention and analytics dashboards for Aave V3 is now live for Optimism, Polygon, and Avalanche! The user retention dashboard tracks repeat users, and measures user engagement and user behavior over time on Aave v3. Of note, Avalanche has the highest number of repeat depositing users at 68%, followed by Optimism at 64%, and Polygon at 4%. Check out the full post for more insights, a comparison between V2 and V3, links to all their dashboards and more. Explore Aave user retention with DappLooker today!

// Protocol 📰

-

After a successful governance vote, the Aave - StarkNet bridge is live. This means you can send aUSDC to Starknet and it will keep earning interest while you're there! Read more about this and other governance updates in the Governance ⚖️ section.

-

With V3 deploying on Ethereum soon, Stani shared a thread about V3 including some history and why the flexible architecture is much appreciated

// Ecosystem 🧉

-

Aave Grants was featured in an article by Gitcoin highlighting successful grants programs in web3 👻

-

@boardroom_info highlighted recent events around Aave in their latest Boardroom Brief including the proposal from Llama, Gauntlet, Chaos Labs, 3SE Holdings & @ItsFreeRealEstate to halt all listings on V1 and V2.

-

Goldfinch is hosting a Twitter Spaces discussing how Aave can leverage RWAs and considerations for an RWA market for GHO - set a reminder for December 14th!

-

Gauntlet shared a list of the risk related governance activity from the past two months.

**// Governance ⚖️ - written by Boardroom

Lots of risk-related actions and discussions over the past week, and several important risk-related discussions and decisions ahead.

/ Proposals

👻 Aave Improvement Proposals:

-

Aave StarkNet Phase I - Aave <> StarkNet Bridge deployment/activation by Aave governance (127). Aave hopes to expand to StarkNet, a “validity” or “ZK” rollup, and this proposal presents the first step in doing so, beginning with creating “a bridge of Aave v2 Ethereum aTokens from/to StarkNet.” The proposal passed with almost 100% voting “YAE” and is queued for execution.

-

Risk Parameter Updates for Aave v2 Polygon (126). This proposal failed on November 30 because it did not reach quorum.

-

Risk Parameter Updates for Aave v2 Ethereum Liquidty Pool (125). This proposal succeeded with almost 100% voting “YAE” and was executed on November 30.

⚡️ On Snapshot:

-

[ARFC] Aave DAO Policy Change: Halt Listings on all Aave v1 & v2 Non Permissioned Deployments. The crux of this proposal is that it “advocates only enabling future asset listings to occur on Aave v3 deployments”. If the proposal were to pass, no new assets could be added to Aave v2. This would effectively begin the transition from v2 to v3. The sunsetting of Aave v1 has been actively discussed on the Aave forums since late August, while discussions of the migration from Aave v2 to v3 (and the subsequent deprecation of v2) have been active since mid November of this year. Several key players in the Aave DAO are now urging the community to find ways begin to close off the v1 and v2 markets so that usage of the much less risk prone Aave v3 will increase.

-

Activation of a ParaSwap fee claimer contract. This proposal passed on November 29 with over 99% voting to approve.

🗣 Provide your feedback on these active Aave Requests for Comment (ARCs):

-

[ARC] Interest Rate Curve Changes for Aave v2 ETH. Gauntlet proposes to change interest rate parameters and reserve factors for USDT and TUSD. “Many interest rate curves on Aave have not changed for a long time and, in the case of some assets, have never been updated for the lifetime of the asset listing.”

-

[ARFC] Ethereum v2 Collector Contract Consolidation. A proposal from @llamaxyz to consolidate “the Aave v2 Collector Contract holdings by swapping a portion of the long tail assets to USDC and redeeming assets from the Aave AMM deployment.”

-

[ARC] Risk Parameter Updates for Aave v2 Ethereum - LT and LTV (2022.12.01). Chaos Labs proposes to “adjust 4 total risk parameters, including Liquidation Threshold (LT) and Loan-To-Value (LTV), for USDC and DAI markets.”

-

[ARC] Repay excess debt in CRV market for Aave V2 ETH. Discussion continues.

/ In the Forums

Add OP as collateral to Aave v3. @pauljlei provides the market risk assessment.

Oracle analysis. @OriN from Chaos Labs looks at BTC vs. WBTC as part of a longer discussion about pricing mechanisms.

Llama month 2. Updates from the team.

All the Q4 risk-off measures, summarized by Gauntlet.

Improve permissions management. This discussion continues with several new contributions.

More on real-world assets. @Puniaviision notes that Goldfinch will hold a Twitter Space on the subject on December 14.

Delegate platform updates from @lbsblockchain, Flipside Crypto, and the Aave Chan Initiative.

/In Discord

What’s the difference between a Snapshot vote and an AIP?

Who carries out the changes decided by governance?

Quick Gov Links: Governance FAQ | Governance Docs | Discord Governance Channel | Snapshot | AIPs | Aave on Boardroom

// Events 📆

If you could only go to one event in 2023, which event would it be? DM us on Twitter or Lens 🌿

// Hey Anon 👻

Did you see the latest episode of Up Only with Rebecca from Aave Companies talking about the regulatory landscape for crypto post-FTX?